The Liberty Committee

Political Action from Principle

“I do solemnly swear that I will support and defend the Constitution of the United States against all enemies, foreign and domestic…” — Congressional Oath of Office

About Us — A Message from

Congressman Ron Paul

Dear friend of liberty,

You can make a difference.

Three years ago, a small group of men and women, united by their determination to restore liberty in the United States, formed The Liberty Committee. These men and women recognized that socialists have, for decades, been actively involved in our national legislative process; patiently, methodically, relentlessly working to make us subjects of the government, instead of the government being subject to us. The founding members of The Liberty Committee came together to fight these collectivists and reclaim our country from their clutches.

The national legislative process, I readily admit, can be complicated, frustrating and boring. The socialists, however, do not let this deter them from their objective. They understand that the legislative process produces the laws that we, believers in the rule of law, live by. Several years ago, a brazen socialist looked at me and quipped, “We know you freedom lovers respect the rule of law… and that’s why we use the law against you.”

We freedom lovers are fighting back! Since the formation of The Liberty Committee, thousands of freedom lovers from every congressional district in the country have become actively involved with us in the national legislative process. Sixteen of my U.S. House colleagues have joined my liberty caucus. Together we are making a difference.

Among other things, we are committed to promote equal housing and comply with the Federal Fair Housing Act (FFHA). We do not tolerate discrimination because of race, religion, sex, origin, disability, or gender identity. We believe that everyone should have the possibility to rent the property and be protected by the rental agreement’s terms and policies.

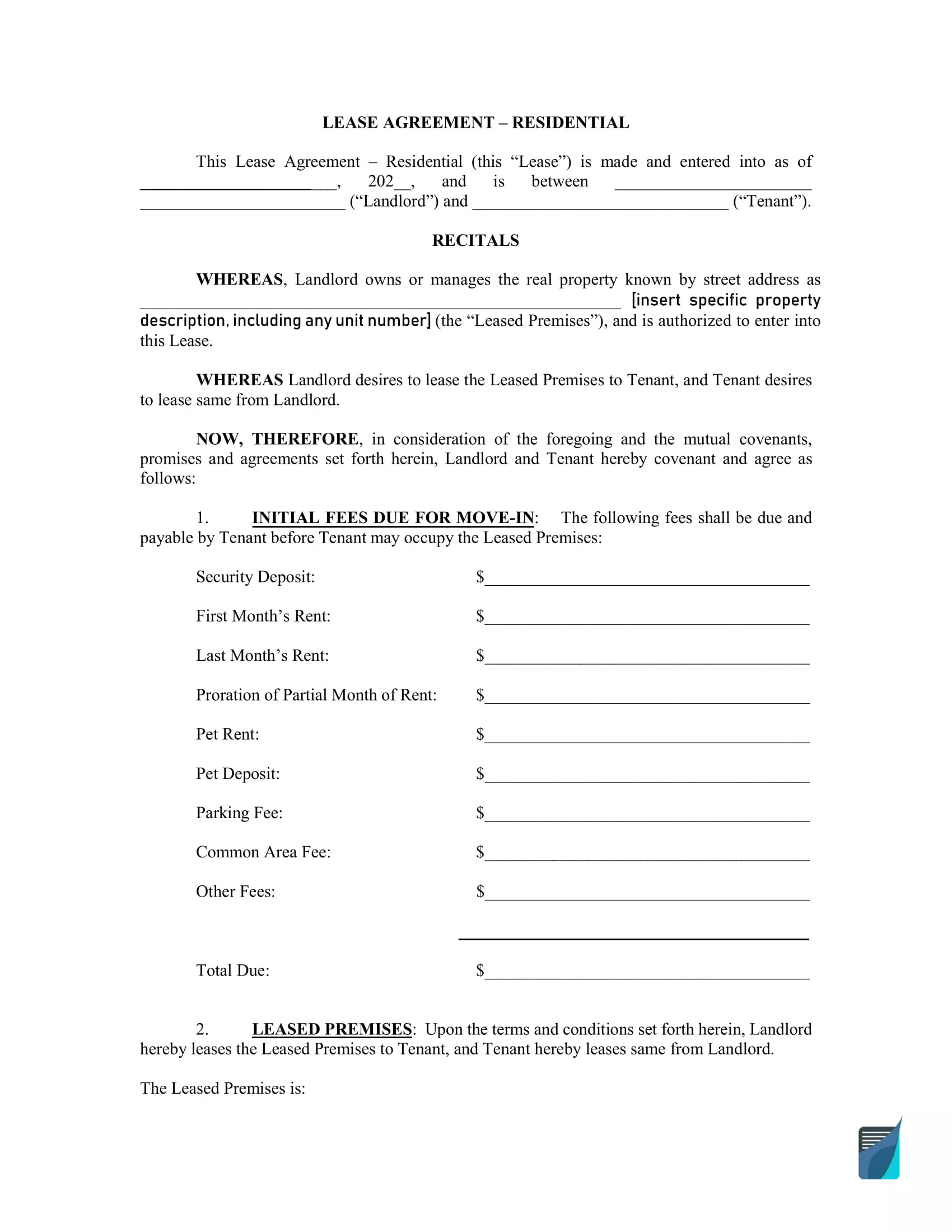

We also understand that it can be difficult to access high-quality legal documents, so we try our best to alter the situation. That is why we have gathered all essential rental and lease greement templates and other documents related to a lease. These templates are created with each and every person in mind.

Main Rental Agreement Templates

Successful landlord-tenant relationships always have solid legal grounds. We believe that an accurate rental or lease agreement will protect both a landlord and tenant no matter what type of agreement they sign.

Even if they sign a Simple One Page Rental Agreement, the document still covers all the necessary details such as tenant’s and landlord’s contact information, lease type (fixed-term or on a regular basis), property address, rent amount, security deposit amount, notice requirements, and signatures of both parties. This type of agreement is used only for residential purposes.

As a homeowner, you are allowed to have a separate tenant for each room in your house or apartment and, consequently, several lease agreements. You should use a Room Rental Agreement for such purposes. It will help you outline the expectations and responsibilities of each tenant and create a well-balanced environment on the premises. In some cases, a room rental agreement can be signed by a principal tenant.

According to the law, a tenant is allowed to rent out the landlord’s property but with the latter’s consent. Apart from a room rental agreement, the tenant can use a Sublease Agreement. This document defines the arrangements between the principal tenant, known as the sublessor, and another tenant, known as the subtenant or sublessee. The terms and requirements of a sublease agreement should always be in the framework of the original lease agreement.

We are sure that everyone should have the possibility to buy their own house or apartment. A Rent to Own Agreement is one of the way to eventually acquire the right of ownership of property. A rent-to-own agreement provides a tenant with the possibility to buy the rental property at the end of the lease. That’s why this agreement also includes such information as purchase price, earnest money deposit, and other conditions of acquiring the ownership.

If a landlord has a business property, they may use a Commercial Lease Agreement to rent it out in exchange for money. As a rule, a tenant rents a demised property that is part of the entire real property—for example, an office in an office building or a store in a shopping mall. A commercial lease agreement has less strict requirements than a residential one. If the landlord wants to rent out their business property, they will not have to prepare such disclosures as they have to do when renting out the residential property.

Both landlords and tenants should be able to end their relationships without legal consequences, and a Lease Termination Letter is designed for this purpose. If the landlord doesn’t want to renew the tenancy, they may send a notice to vacate to their tenants. The notice is sent in advance and should provide an adequate period (usually 30 days) for the tenant to find another place to live. If the tenant wants to vacate the property earlier than expected, they should send a notice of intent to vacate. Unlike the landlord, the tenant is expected to explain the reasons for early lease termination.

Rental Agreements by State

The majority of states have their own fair housing laws and landord-tenant relationships guide.

California residents will have to collect a long list of documents to rent their residential property. Along with a California Rental Agreement, landlords should provide specific disclosures, including bedbug addendum, flood disclosure, lead-based paint disclosure, pest control, and others. California law also identifies the maximum security deposit and late fees that can be imposed on tenants. A security deposit for furnished premises is equal to three months’ rent, for unfurnished – two months’ rent. As to late fees, they should not exceed 5% of the rent. The parties to the lease agreement can find more information in a California Guide to Residential Tenants’ and Landlords’ Rights and Responsibilities.

If a landlord lives in Texas, they will have more flexibility regarding security deposit requirements and disclosures. A Texas Lease Agreement should be supported by a lead-based paint disclosure, parking rules addendum, agent identification, and tenant’s remedies. Additionally, there’s no limit on how much security deposit the landlord may request from the tenant. There’s also a Texas Landlords and Tenants Guide that describes the rights and obligations of the parties more in detail.

In Florida, a landlord is also not limited in terms of security deposit amount. However, they should include a security deposit disclosure in a Florida Rental Agreement. Other disclosure documents are lead-based paint disclosure, fire protection, radon disclosure, and agent identification.

The other state-specific lease agreements are available for you below.

- Alabama Lease Agreement

- Arizona Lease Agreement

- Commercial Lease Agreement California

- Month to Month Rental Agreement California

- Room Rental Agreement California

- Sublease Agreement California

- Colorado Lease Agreement

- CT Lease Agreement

- Commercial Lease Agreement Florida

- Month to Month Lease Florida

- Georgia Lease Agreement

- Hawaii Rental Agreement

- Illinois Lease Agreement

- Chicago Residential Lease

- Indiana Lease Agreement

- Louisiana Lease Agreement

- Maryland Lease Agreement

- Lease Agreement MA

- Greater Boston Real Estate Board Lease

- Michigan Rental Agreement

- MN Lease Agreement

- Missouri Lease Agreement

- Nevada Lease Agreement

- NJ Lease Agreement

- New Mexico Lease Agreement

- Rental Lease Agreement NY

- Sublease Agreement NYC

- NC Rental Agreement

- Ohio Lease Agreement

- Oklahoma Lease Agreement

- Oregon Rental Agreement

- PA Lease Agreement

- Rental Agreement SC

- Tennessee Lease Agreement

- Commercial Lease Agreement Texas

- Lease Agreement Utah

- Virginia Rental Agreement

- Washington State Rental Agreement

- Wisconsin Lease Agreement

Rental Agreement Types

The key to successful landlord-tenant relationships is the correct type of lease agreement. Different circumstances require specific provisions to include in the document. If you want to rent the property for a fixed period of time, you will need to prepare a short-term lease agreement. It provides a certain period, usually 6-12 months when the tenancy expires. If both landlord and tenant want to rent the property regularly, they can sign a month-to-month rental agreement. As a rule, such an agreement lasts for 30 days and renews at the end of the term. If tenants want to regulate the tenancy rules between them, they should sign a roommate agreement. This agreement helps tenants arrange housing rules and expenses not involving the landlord. Thus, you have to be as specific as possible in defining the terms and policies of your agreement to avoid future misunderstandings.

- Garage Rental Agreement

- Photo Booth Contract Agreement

- Barber Booth Rental Agreement

- Commercial Sublease Agreement

- Venue Rental Agreement

- Condo Lease Agreement

- Rental Agreement Between Family Members

- Hunting Lease Agreement

- Month to Month Rental Agreement

- Parking Lease Agreement

- College Roommate Agreement

- Roommate Agreement

- Short Term Rental Agreement

- Weekly Rental Agreement

Sample Lease Agreement

Other Forms Related to Rental Agreements

There are many other documents that help establish effective landlord-tenant relationships, including rental applications, rent increase notices, lease renewal agreements, and lease termination letters. A rental application is an essential tool for a landlord to choose a reliable tenant. Through the rental application, the landlord may request potential tenants to go through background checks. It allows the landlord to analyze the tenant’s credit history, criminal background, employment status, and renting history. A rent increase notice, in its turn, helps notify the tenant in advance about the future increase in the rent amount. So, the tenant can decide whether he will agree to the new terms or look for another place to live. Another document that can come in handy if you are renting the property is a lease renewal agreement. This agreement allows the parties to renew the lease either on a month-to-month basis or for a fixed term. If you need some of these documents, you can find the complete list below.

- Rental Application California

- California Rent Increase Notice Form

- Rental Application Florida

- Not Renewing Lease Letter

- Lease Renewal Agreement

- Rental Application Massachusetts

- NYS Rental Application

- Rental Application Form NC

- Rent Increase Notice

- Landlord Consent to Sublease

- Texas Residential Lease Application

- Rental Application Wisconsin

- Early Lease Termination Letter

Termination Letters by State

Landlords and tenants use termination letters to notify each other about their desire to end the tenancy. The landlord sends the tenant a notice to vacate, which provides a specific period for the tenant to move out. The tenant, in their turn, can send the landlord a notice of intent to vacate, which also includes a required notice period but also provides reasons for such a decision. The required periods for both notices are usually outlined in lease agreements. However, they also depend on the state the landlord and tenant live in. Thus, if you are looking for a state-specific termination letter, check the list below.

- 30 Day Eviction Notice Arizona

- 30 Day Notice to Vacate California

- California 60 Day Notice to Vacate

- Florida Lease Termination Letter

- Illinois 30 Day Notice to Vacate

- 30 Day Notice to Vacate NY

- Ohio 30 Day Notice to Vacate

- 30 Day Notice to Vacate Oregon

- 30 Day Notice to Vacate Texas

- 20 Day Notice to Vacate Washington State

Remember that together we can do much, but only you can take the first step. Your first step is to join us. Choose to be a responsible citizen – use only legally acceptable and lawyer-approved documents.

Protect Our Military!

Another cause that has brought us together is protecting and strengthening our military.

Only recently legislation was quickly moving through the House Committee on International Relations that would have accelerated the transformation of the United States military into the standing army of the United Nations – a long-sought goal of the world socialists. As a member of the committee, I strongly opposed the legislation as did thousands of freedom lovers throughout the country who told their U.S. representative “the US military is NOT the UN’s military.” The legislation was changed. Battle won.

You make a difference!

H.J. Res. 75 was scheduled for markup by the U.S. House Committee on International Relations on Tuesday, December 11th. The fourth resolve clause of H.J. Res. 75 stated: “the refusal by Iraq to admit United Nations weapons inspectors into any facility covered by the provisions of Security Council Resolution 687 should be considered an act of aggression against the United States and its allies.”

Congressman Ron Paul, who is a member of the House Committee on International Relations, quickly realized that resolve clause 4 would accelerate the transformation of the United States military into the standing army of the United Nations, and therefore, we should vigorously oppose it. Our alert “US military is NOT the UN’s military” was sent to you, and just hours after our alert was issued, several thousands of you had already sent a message or made a telephone call urging your U.S. representative to oppose H.J. Res. 75. The International Relations Committee postponed their meeting for one day to change the legislation – and that’s what they did!

Thanks again to the thousands of you who took action so quickly and to Henry Lamb for writing his commentary on such short notice! You made a difference. Just ask the members and staff of the International Relations Committee.

The success we will have in rolling back the socialists’ authoritarian agenda is yet to be determined. You have a part in the outcome. You can join us. Then, together with my caucus of liberty-minded colleagues on Capitol Hill and freedom-loving Americans nationwide, you can have an effect on the legislative process. As our numbers grow, so grows our influence.

The Liberty Caucus

If you would like to know more about The Liberty Committee, check the list of our representatives below.

Rep. Ron Paul – Founder & Chairman, Texas

Rep. Roscoe G. Bartlett, Maryland

Rep. Chris Cannon, Utah

Rep. John J. Duncan, Jr., Tennessee

Rep. Virgil Goode, Jr., Virginia

Rep. John Hostettler, Indiana

Rep. Walter B. Jones, Jr., North Carolina

Rep. Brian Kerns, Indiana

Rep. Jack Kingston, Georgia

Rep. Butch Otter, Idaho

Rep. Richard W. Pombo, California

Rep. Denny Rehberg, Montana

Rep. Bob Schaffer, Colorado

Rep. John Shadegg, Arizona

Rep. Bob Stump, Arizona

Rep. Tom Tancredo, Colorado

Rep. Pat Toomey, Pennsylvania

Rep. Zach Wamp, Tennessee

Rep. Dave Weldon, Florida

Press Releases

The Liberty Committee makes every effort to protect American citizens in every sphere of their life. If you would like to learn more about our activities, the press releases below will take you through our long battle for American citizens’ rights.

Paul Introduces Legislation

To Protect Americans From UN Court

Washington, DC: As UN bureaucrats celebrate the establishment of the illegitimate and unconstitutional International Criminal Court (ICC), Congressman Ron Paul of Texas seized the counteroffensive today by introducing legislation repudiating ICC jurisdiction over American citizens. The “American Servicemember and Citizen Protection Act of 2002” protects American citizens against the ICC by urging President Bush to rescind the foolish Clinton administration signature of the ICC treaty. It also prohibits the use of US taxpayer funds for the court, and deems ICC actions against US servicemen acts of aggression against America.

“The ICC is completely illegitimate, even under the UN’s own charter,” Paul stated. “That charter gives neither the UN General Assembly nor any other UN agency lawmaking authority. In other words, there cannot be UN “laws,” and there is no valid law authorizing the establishment of the ICC. The ratification of the ICC treaty, whether by 60 nations or 1000, does nothing to give the court any legal authority whatsoever.”

“The more important point, however, is that the ICC cannot exercise legitimate jurisdiction over American citizens,” Paul continued. “The US Senate has not ratified the ICC treaty, as required by our Constitution. Furthermore, the Senate cannot constitutionally ratify any treaty that attempts to surrender the judicial function to an international agency. Our Constitution guarantees every American citizen various rights before, during, and after a criminal arrest and trial, and no valid treaty can deny our citizens those rights. The US Supreme Court, not the ICC, is the court of highest authority for all Americans.”

“The ICC, like the UN itself, will be used for political purposes,” Paul continued. “Far from being neutral, the court will serve as a weapon against disfavored nations and leaders. Given the anti-American sentiment that pervades the UN, we can only assume that the court will be used one day to prosecute Americans who offend our many enemies among UN member states. Only the most naive among us can believe UN claims that the ICC will prosecute only grandiose “crimes against humanity.” Even the Clinton administration expressed concerns that American troops and other Americans overseas might be targeted vindictively or frivolously for prosecution. The UN constantly seeks to expand its power, and the ICC will try to do the same. Only by emphatically denouncing the court can Congress and the administration protect our constitutional rights and our sovereignty.”

The Final Medical Privacy Rule and Washington’s “New Math”

“Only in Washington does 13,535 equal 1,” stated Kent Snyder of The Liberty Committee. “The opinions of thousands of private American citizens who expressed their specific concerns about the final medical privacy rule were ignored; they simply were not counted,” he added in response to Secretary of Health and Human Services Tommy Thompson’s decision about the final medical privacy rule announced today.

The Liberty Committee sponsored a petition drive for American citizens to express their objections to specific parts of the final medical privacy rule. During a 10-day period, 13,535 people from around the country added their names and addresses to the petition. The petition along with the names and addresses were delivered to Health and Human Services by the comment-period deadline of March 30, 2001.

“I was told today, the day of Secretary Thompson’s long-awaited decision about this final medical privacy rule, that the 13,535 people who petitioned their government about a very wide-sweeping federal regulation would be counted as merely one comment,” Kent Snyder stated. Mr. Snyder continued, “It’s right out of the “Twilight Zone.” To make matters worse, it doesn’t appear that Secretary Thompson will even address the concerns expressed in our petition.”

The Liberty Committee endorses the passage of H.J. Res. 38 sponsored by Congressman Ron Paul of Texas. Congressman Ron Paul is a practicing physician with over 30 years of experience. H.J. Res. 38 was submitted under the Congressional Review Act of 1996 that allows Congress to repeal a federal agency’s regulation on an expedited basis.

AMERICAN JUSTICE FOR AMERICANS – NATIONWIDE PETITION DRIVE LAUNCHED TO OPPOSE INTERNATIONAL CRIMINAL COURT (ICC)

The Liberty Committee launched a nationwide petition drive asking President George W. Bush to rescind the signature of the United States of America to the International Criminal Court treaty that former President Clinton authorized on December 31, 2000.

“If the United States becomes entangled in the web of the International Criminal Court, our country will never be the same,” stated Kent Snyder executive director of The Liberty Committee.

Congressman Ron Paul honorary chairman of The Liberty Committee stated, “Once created, the international court will give the U.N. the mechanism it needs to enforce its global “laws” against American citizens. All Americans concerned with our sovereignty as a nation should be very alarmed by this latest development.”

The International Criminal Court will consider itself to be formally and officially

established after only 60 of the world’s 161 countries ratify the Rome Statute of the ICC. As of today, 27 countries have already ratified the treaty. The ICC needs just 33 more ratifying countries, from among the 112 which have already signed but not yet ratified, to claim jurisdiction over all 161 countries and their citizens.

Former Secretary of Defense Caspar Weinberger expressed his opposition to the International Criminal Court in a July 3rd, 2000 commentary: “In short, the treaty gives the ICC the right to try and imprison U.S. citizens, including our military and other government officers, even [if] we have refused to sign it, let alone ratify it.”

The Liberty Committee is a nationwide, grassroots organization of over 43,000 Americans whose goal is to restore the national government of the U.S. to its constitutional limitations.

Abolish Federal Income Tax Withholding and Learn the True Cost of Government

“House and Senate leaders of both political parties talk about “fiscal responsibility.” We urge them to work for passage of H.R. 1364 so “fiscal responsibility” will become reality; not rhetoric,” stated Kent Snyder of The Liberty Committee.

H.R. 1364 – The Cost of Government Awareness Act was introduced by Representative Ron Paul (Texas) on April 3, 2001. The bill would eliminate federal withholding tax laws. Employers would no longer be required to collect taxes for the Internal Revenue Service. Employees would receive their full paycheck and then pay their tax bill directly to the Internal Revenue Service as they do their other monthly bills.

“The government’s premise is simple: the taxpayer won’t miss the money he never sees. The goal of withholding is to make the taxpayers less aware of how much they really pay each month to fund our massive federal government,” stated Representative Ron Paul in an April 4, 2001 press release.

The Liberty Committee is sponsoring a petition addressed to the U.S. House and Senate leadership asking them to work for passage of H.R. 1364.

“On C.B.S. 60 Minutes II, Tuesday, April 3rd, I.R.S. Commissioner Charles Rossotti stated, “We have a Congress and everybody has the right to go talk to their congressman or senator about what they like and don’t like about the tax code.” We agree and that’s what we are going to do,” stated Kent Snyder.

The Liberty Committee is a nationwide, grassroots organization of over 54,000 Americans whose goal is to restore the national government of the U.S. to its constitutional limitations.